On this planet of finance, decision-making is important. The most efficient selections are those that depend on correct information assortment and computation. The Inner Price of Go back (IRR) is an impressive metric that is helping measure the prospective go back on an funding through the years. Execs and finance fans make use of the method for IRR in Excel to calculate IRR. Assessment the method and the applying of this crucial monetary instrument.

What’s the IRR Serve as?

IRR stands for Inner Price of Go back and is one in all Excel’s monetary purposes. It calculates the prospective benefit within the funding or venture the place money waft is common at any mounted period.

The IRR serve as determines the interior fee of go back via calculating the velocity at which the web provide price (NPV) turns into 0. It signifies the venture’s monetary viability. Thus, the IRR serve as in Excel is helping in figuring out the proportion at which the money inflows fit the money outflows. So, when NPV = 0, there’s no achieve or loss, whilst in terms of a good go back, NPV > 0, i.e., a winning project.

IRR Method

The syntax for the IRR method or method for IRR in Excel is:

|

Right here, ‘values’ is the specified argument and represents the numbers for calculating the interior fee of go back. It comprises funding and web source of revenue values. Customers too can come with a spread of cells with values.

‘Wager’ is the non-compulsory argument and represents the anticipated inside fee of go back. Since it’s non-compulsory, leaving it clean will take a default price of 0.1 or 10%.

Necessary Issues to Take note:

- The order of values determines the money flows.

- The empty texts, cells or logical values are overlooked.

- The argument should have funding as a destructive price and returns as a good price.

The right way to use the IRR Serve as in Excel?

Allow us to take the next instance to know the IRR serve as in Excel.

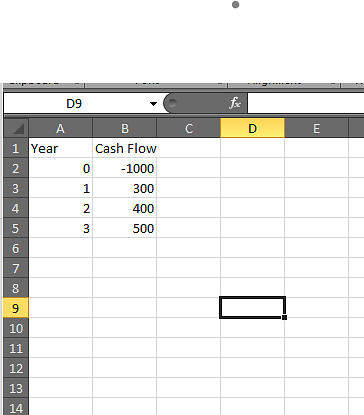

Alt-text: Collection representing money flows

- Step 1: The money waft here’s arranged chronologically, and funding is written on best in destructive. It’s -1000. The remainder ones are returns for the particular yr.

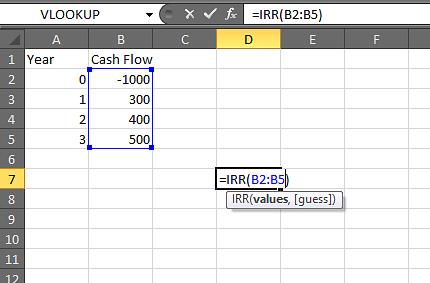

- Step 2: Write the method and input the variability of cells. Right here the funding is in B2 and returns for 3 years are in B3, B4 and B5.

Alt-text: Image appearing access of IRR method

- Step 3: The ensuing price is 9%.

Alt-text: Image appearing generated IRR

Decoding the consequences, the solution manner the person with said investments and returns gets an IRR of roughly 9%. It additional implies that the funding would generate a go back of round 9% benefit.

IRR vs XIRR

The XIRR vs IRR refers back to the Prolonged Inner Price of Go back and the Inner Price of Go back, respectively. The previous considers money waft at common durations, whilst XIRR considers them at abnormal durations or at non-periodic spans. It provides upper flexibility because it intakes entries at a particular date. The syntax for XIRR is:

|

Since this serve as considers abnormal dates, the column specifying them could also be thought to be.

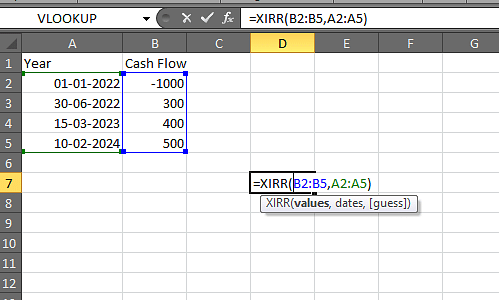

For example, allow us to take the similar earlier entries with explicit and abnormal discussed dates.

Alt-text: Dates and money waft specifying the abnormal length

Step 1: Input the dates and money waft.

Alt-text: Method of XIRR for abnormal intervals of money waft

Step 2: Input the method. The syntax calls for the enter of each values and dates within the said order. We write that first because the money waft is given from B2 to B5. Following it’s the vary of cells bringing up date from A2 to A5.

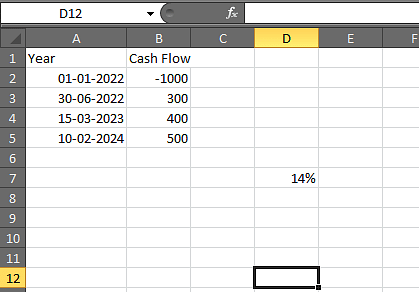

Alt-text: Image appearing XIRR

- Step 3: The ensuing price here’s 14%

Decoding the end result, we see the price returned right here isn’t like IRR. The alternate in price is owed to express dates appearing abnormal intervals, which alters the calculation way. In comparison to IRR, XIRR is thought of as extra correct because of the dignity of dates.

IRR and NPV in Excel

NPV, or Web Provide Price, signifies the price of cash through the years. It makes use of the funding to state the prospective go back quantity. Additional, the comparability regarding the price of cash additional implicates its value. The NPV can also be certain or destructive, the place the previous is thought of as higher, and the decrease or destructive NPV is thought of as deficient, owing to the technology of much less cash than funding. The ensuing NPV price signifies the benefit, whilst IRR signifies the velocity of go back.

The syntax for NPV is: “=NPV(bargain fee, vary of money flows).”

For example, allow us to believe the former instance and put within the fee of go back of 8%. The NPV is INR 16.32 right here.

Alt-text: NPV for the former instance at a bargain fee of 8%

Make a selection the Proper Program

Having a look to construct a profession within the thrilling box of information analytics? Our Knowledge Analytics classes are designed to give you the abilities and information you wish to have to excel on this unexpectedly rising {industry}. Our knowledgeable instructors will information you via hands-on tasks, real-world eventualities, and case research, supplying you with the sensible enjoy you wish to have to be triumphant. With our classes, you’ll be able to learn how to analyze information, create insightful studies, and make data-driven selections that may lend a hand force trade luck.

Program Title

Knowledge Analyst Publish Graduate Program In Knowledge Analytics Knowledge Analytics Bootcamp To be had in International International US College Simplilearn Purdue Caltech Direction Period 11 Months 8 Months 6 Months Coding Revel in Required No Elementary No Abilities You Will Be informed 10+ talents together with Python, MySQL, Tableau, NumPy and extra 10+ talents together with

Knowledge Analytics, Statistical Research the use of Excel, Knowledge Research Python and R, and extra8+ Knowledge Visualization with Tableau, Linear and Logistic Regression, Knowledge Manipulation and extra Further Advantages Carried out Finding out by means of Capstone and 20+ industry-relevant Knowledge Analytics tasks Purdue Alumni Affiliation Club

Loose IIMJobs Professional-Club of 6 months

Resume Development HelpGet right of entry to to Built-in Sensible Labs Caltech CTME Circle Club Value $$ $$$$ $$$$ Discover Program Discover Program Discover Program

Conclusion

Knowledge analytics is among the trending fields, steadily requiring talent in Microsoft Excel or Google Sheets for group and knowledge research. The pros also are anticipated to be well-versed in the most recent instrument and statistical research tool. Guiding you via a lot of integrated purposes similar to the discussed instance, the Publish Graduate Program in Knowledge Analytics is obtainable via Purdue College and IBM professionals. The path guarantees profession mentorship along side much-needed hands-on enjoy.

FAQs

1. How do you calculate IRR from NPV in Excel?

Write the syntax for IRR to search out the IRR price from NPV in Excel.

2. Can IRR be calculated manually?

The method for handbook calculation of Inner Price of Go back:

Inner Price of Go back (IRR)=(Long run valuePresent price)1Number of periods-1

3. How do I calculate IRR via month in Excel?

Use XIRR to calculate IRR via month in Excel. Make sure that to place within the months.

supply: www.simplilearn.com